How Insurance Adjusters Calculate Settlement Offers

How Insurance Adjusters Calculate Settlement Offers, When someone suffers an injury due to another’s negligence, one of the first questions often centers around the potential settlement amount. Insurance adjusters use various methods to calculate these figures. Medical expenses serve as a foundational element in determining the value. Receipts for treatments, prescriptions, and any required medical equipment help to quantify these costs. Another key aspect involves lost wages. Adjusters consider these economic losses if an individual misses work or can no longer perform their job. Pain and suffering also factor into the equation, albeit less straightforward. Adjusters may employ specific formulas or multipliers to quantify emotional or physical distress. Circumstances of the incident itself, such as the degree of negligence or intent, can influence the overall settlement.

Role of Medical Records in Valuing Injury Settlements

Medical records serve as vital pieces of evidence in personal injury cases, especially when it comes to calculating settlement offers. These documents provide a comprehensive look at the nature and extent of injuries sustained, offering adjusters a basis for financial valuation. They contain diagnostic tests, treatments administered, and prescriptions given, painting a detailed picture of the healthcare journey from initial injury to recovery or ongoing care. The inclusion of all relevant records is important for a more accurate settlement calculation. Omitted or incomplete information could result in a less favorable offer.

Lost Wages Calculation in Settlement Offers

Lost wages play a significant role in determining the value of settlement offers in personal injury cases. When an individual is injured and unable to work, it directly impacts their financial stability. Insurance adjusters take these economic losses into account to arrive at a more equitable settlement figure. Documentation such as pay stubs, tax returns, and even letters from employers can serve as evidence to support a claim for lost wages.

A Closer Look at Pain and Suffering in Insurance Assessments

Pain and suffering often present a challenge when calculating settlement offers in personal injury cases. Unlike medical expenses or lost wages, emotional and physical distress lack a straightforward numerical value. Insurance adjusters typically use certain methods to assign a monetary figure to these more subjective elements.

One common approach involves applying a multiplier to the sum of medical expenses and lost wages. Depending on the severity of pain and suffering experienced, the multiplier can range from a low to a high number. Another technique involves per diem calculations, where a daily rate is assigned and then multiplied by the number of days the person has suffered since the incident.

Unveiling Common Strategies Employed by Insurance Adjusters in Settlements

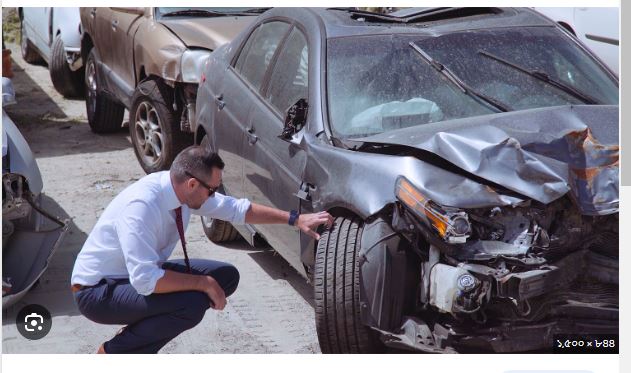

Insurance adjusters aim to limit payout amounts, aiming to resolve claims in a manner most financially favorable for the insurance company. A variety of strategies may be employed to achieve this end. One such method is the initial lowball offer, designed to entice uninformed claimants to accept less than they might be entitled to. Another tactic involves questioning the severity of injuries, often requesting additional documentation or even independent medical examinations to challenge claims.

Adjusters also meticulously scrutinize medical records and other evidence, searching for inconsistencies or gaps that could weaken a claimant’s case. Delay is another common strategy. The longer a case drags on, the more financial strain is placed on the injured party, who might eventually feel compelled to settle for less due to mounting bills and expenses.